HAYWARD, Calif., May 13, 2024 (GLOBE NEWSWIRE) -- Benitec Biopharma Inc. (NASDAQ: BNTC) (“Benitec” or “Company”), a clinical-stage, gene therapy-focused, biotechnology company developing novel genetic medicines based on its proprietary “Silence and Replace” DNA-directed RNA interference (“ddRNAi”) platform, today announced financial results for its third fiscal quarter ended March 31, 2024. The Company has filed its quarterly report on Form 10-Q with the U.S. Securities and Exchange Commission.

“The interim clinical trial results for the first subject enrolled onto the BB-301 Phase 1b/2a Clinical Treatment Study demonstrated consistent, clinically meaningful improvements in each of the central study endpoints, with significant improvements noted across the radiographic assessments of swallowing and corresponding improvements observed for the key subject-reported outcome measure,” said Jerel A. Banks, M.D., Ph.D., Executive Chairman and Chief Executive Officer of Benitec. "We look forward to presenting the results of longer-term follow-up for the first study subject, along with the accruing data for additional study subjects, later this year”. “Following the recent financing, Benitec is well-positioned to advance the BB-301 clinical development program through the end of 2025.”

Operational Updates

On April 18th the Company announced an oversubscribed $40.0 million private investment in public equity (PIPE) financing from the sale of 5,749,152 shares of its common stock at a price per share of $4.80, and, in lieu of shares of common stock, pre-funded warrants to purchase up to an aggregate of 2,584,239 shares of its common stock at a price per pre-funded warrant of $4.7999, to certain institutional accredited investors.

The financing was led by Suvretta Capital Management, LLC with participation from new and existing investors including Adage Capital Partners L.P., Nantahala Capital, multiple healthcare-focused funds, and a leading mutual fund. Gross proceeds from the PIPE financing totaled approximately $40.0 million, before deducting offering expenses. The closing of the PIPE occurred on April 22, 2024.

In connection with the PIPE financing, the Company has agreed with long-term investor Suvretta Capital Management to consider Kishen Mehta, a portfolio manager at Suvretta Capital Management, for appointment to the Company’s board of directors.

The key milestones related to the development of BB-301 for the treatment of OPMD-related Dysphagia, along with other corporate updates, are outlined below:

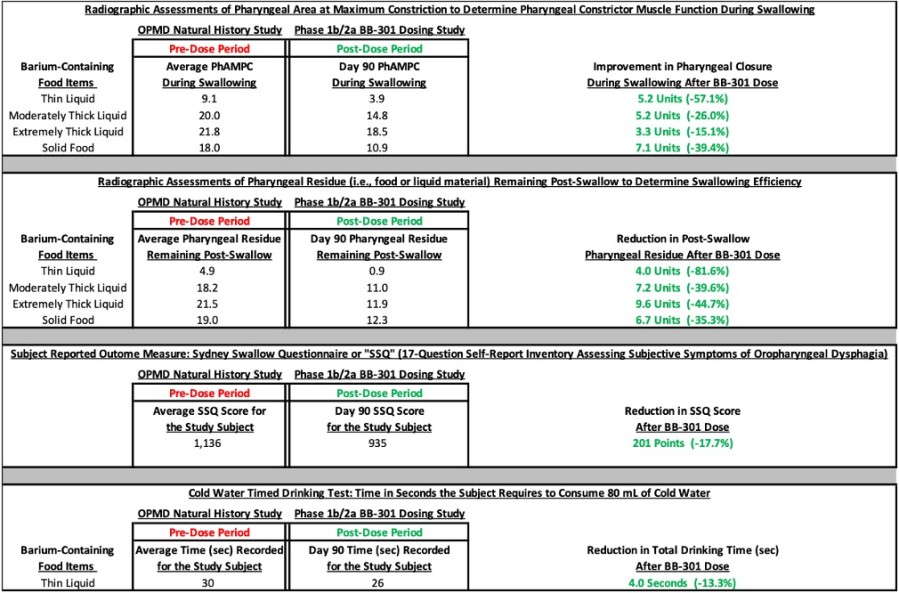

Interim BB-301 Phase 1b/2a Clinical Treatment Study Results for Subject 1:

Figure 1: Improvement in All Outcomes at 90-Days Post-BB-301 Injection*

*Company data on file

Corporate Updates:

Financial Highlights

Third Fiscal Quarter 2024 Financial Results

Total Revenues for the quarter ended March 31, 2024, were $0 compared to $54,000 in licensing revenues collected for the quarter ended March 31, 2023.

Total Expenses for the quarter ended March 31, 2024, were $4.1 million compared to $4.4 million for the quarter ended March 31, 2023. For the quarter ended March 31, 2024, the Company incurred ($3,000) in royalties and license fees due to the reversal of an accrual compared to $0 for the three months ended March 31, 2023. The Company incurred $2.6 million of research and development expenses compared to $3.2 million for the comparable quarter ended March 31, 2023. Research and development expenses relate primarily to ongoing clinical development of BB-301 for the treatment of OPMD. General and administrative expenses were $1.6 million compared to $1.2 million for the quarter ended March 31, 2023.

The loss from operations for the quarter ended March 31, 2024, was $4.1 million compared to a loss of $4.3 million for the quarter ended March 31, 2023. Net loss attributable to shareholders for the quarter ended March 31, 2024, was $4.3 million, or $1.64 per basic and diluted share, compared to a net loss of $4.4 million, or $2.67 per basic and diluted share for the quarter ended March 31, 2023. As of March 31, 2024, the Company had $14.1 million in cash and cash equivalents. Following the closing of the recent PIPE transaction on April 22, 2024, the Company received approximately $37.2 million.

| BENITEC BIOPHARMA INC. Consolidated Balance Sheets (in thousands, except par value and share amounts) | |||||||

| March 31, | June 30, | ||||||

| 2024 | 2023 | ||||||

| (Unaudited) | |||||||

| Assets | |||||||

| Current assets: | |||||||

| Cash at bank | $ | 14,143 | $ | 2,477 | |||

| Restricted cash | 13 | 13 | |||||

| Trade and other receivables | 53 | 55 | |||||

| Prepaid and other assets | 157 | 1,184 | |||||

| Total current assets | 14,366 | 3,729 | |||||

| Property and equipment, net | 204 | 87 | |||||

| Deposits | 25 | 25 | |||||

| Prepaid and other assets | 69 | 97 | |||||

| Right-of-use assets | 335 | 526 | |||||

| Total assets | $ | 14,999 | $ | 4,464 | |||

| Liabilities and stockholders’ equity | |||||||

| Current liabilities: | |||||||

| Trade and other payables | $ | 2,628 | $ | 3,231 | |||

| Accrued employee benefits | 517 | 472 | |||||

| Lease liabilities, current portion | 292 | 275 | |||||

| Total current liabilities | 3,437 | 3,978 | |||||

| Lease liabilities, less current portion | 62 | 284 | |||||

| Total liabilities | 3,499 | 4,262 | |||||

| Commitments and contingencies (Note 11) | |||||||

| Stockholders’ equity: | |||||||

| Common stock, $0.0001 par value—160,000,000 shares authorized; 2,724,794 shares and 1,671,485 shares issued and outstanding at March 31, 2024 and June 30, 2023, respectively | — | — | |||||

| Additional paid-in capital | 197,255 | 168,921 | |||||

| Accumulated deficit | (184,920 | ) | (167,889 | ) | |||

| Accumulated other comprehensive loss | (835 | ) | (830 | ) | |||

| Total stockholders’ equity | 11,500 | 202 | |||||

| Total liabilities and stockholders’ equity | $ | 14,999 | $ | 4,464 | |||

The accompanying notes are an integral part of these consolidated financial statements.

| BENITEC BIOPHARMA INC. Consolidated Statements of Operations and Comprehensive Loss (Unaudited) (in thousands, except share and per share amounts) | |||||||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||||||

| March 31, | March 31, | ||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Revenue: | |||||||||||||||

| Licensing revenues from customers | $ | — | $ | 54 | $ | — | $ | 68 | |||||||

| Total revenues | — | 54 | — | 68 | |||||||||||

| Operating expenses: | |||||||||||||||

| Royalties and license fees | (3 | ) | — | (108 | ) | — | |||||||||

| Research and development | 2,566 | 3,167 | 12,097 | 9,588 | |||||||||||

| General and administrative | 1,578 | 1,228 | 4,953 | 5,011 | |||||||||||

| Total operating expenses | 4,141 | 4,395 | 16,942 | 14,599 | |||||||||||

| Loss from operations | (4,141 | ) | (4,341 | ) | (16,942 | ) | (14,531 | ) | |||||||

| Other income (loss): | |||||||||||||||

| Foreign currency transaction loss | (118 | ) | (45 | ) | (22 | ) | (391 | ) | |||||||

| Interest expense, net | (4 | ) | (7 | ) | (16 | ) | (25 | ) | |||||||

| Other income (expense), net | (16 | ) | — | (50 | ) | 50 | |||||||||

| Unrealized loss on investment | — | (4 | ) | (1 | ) | (4 | ) | ||||||||

| Total other income (loss), net | (138 | ) | (56 | ) | (89 | ) | (370 | ) | |||||||

| Net loss | $ | (4,279 | ) | $ | (4,397 | ) | $ | (17,031 | ) | $ | (14,901 | ) | |||

| Other comprehensive income (loss): | |||||||||||||||

| Unrealized foreign currency translation gain (loss) | 117 | 45 | (5 | ) | 392 | ||||||||||

| Total other comprehensive income (loss) | 117 | 45 | (5 | ) | 392 | ||||||||||

| Total comprehensive loss | $ | (4,162 | ) | $ | (4,352 | ) | $ | (17,036 | ) | $ | (14,509 | ) | |||

| Net loss | $ | (4,279 | ) | $ | (4,397 | ) | $ | (17,031 | ) | $ | (14,901 | ) | |||

| Net loss per share: | |||||||||||||||

| Basic and diluted | $ | (1.64 | ) | $ | (2.67 | ) | $ | (6.95 | ) | $ | (11.47 | ) | |||

| Weighted average number of shares outstanding: basic and diluted | 2,616,288 | 1,645,951 | 2,449,295 | 1,299,423 | |||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

About BB-301

BB-301 is a novel, modified AAV9 capsid expressing a unique, single bifunctional construct promoting co-expression of both codon-optimized Poly-A Binding Protein Nuclear-1 (PABPN1) and two small inhibitory RNAs (siRNAs) against mutant PABPN1. The two siRNAs are modeled into microRNA backbones to silence expression of faulty mutant PABPN1, while allowing expression of the codon-optimized PABPN1 to replace the mutant with a functional version of the protein. We believe the silence and replace mechanism of BB-301 is uniquely positioned for the treatment of OPMD by halting mutant expression while providing a functional replacement protein.

About Benitec Biopharma, Inc.

Benitec Biopharma Inc. (“Benitec” or the “Company”) is a clinical-stage biotechnology company focused on the advancement of novel genetic medicines with headquarters in Hayward, California. The proprietary “Silence and Replace” DNA-directed RNA interference platform combines RNA interference, or RNAi, with gene therapy to create medicines that simultaneously facilitate sustained silencing of disease-causing genes and concomitant delivery of wildtype replacement genes following a single administration of the therapeutic construct. The Company is developing Silence and Replace-based therapeutics for chronic and life-threatening human conditions including Oculopharyngeal Muscular Dystrophy (OPMD). A comprehensive overview of the Company can be found on Benitec’s website at www.benitec.com.

Forward Looking Statements

Except for the historical information set forth herein, the matters set forth in this press release include forward-looking statements, including statements regarding Benitec’s plans to develop and commercialize its product candidates, the timing of the completion of pre-clinical and clinical trials, the timing of the availability of data from our clinical trials, the timing and sufficiency of patient enrollment and dosing in clinical trials, the timing of expected regulatory filings, the clinical utility and potential attributes and benefits of ddRNAi and Benitec’s product candidates, the intellectual property position, the length of time over which the Company expects its cash and cash equivalents to be sufficient to execute on its business plan, and other forward-looking statements.

These forward-looking statements are based on the Company’s current expectations and subject to risks and uncertainties that may cause actual results to differ materially, including unanticipated developments in and risks related to: unanticipated delays; further research and development and the results of clinical trials possibly being unsuccessful or insufficient to meet applicable regulatory standards or warrant continued development; the ability to enroll sufficient numbers of subjects in clinical trials; determinations made by the FDA and other governmental authorities and other regulatory developments; the Company’s ability to protect and enforce its patents and other intellectual property rights; the Company’s dependence on its relationships with its collaboration partners and other third parties; the efficacy or safety of the Company’s products and the products of the Company’s collaboration partners; the acceptance of the Company’s products and the products of the Company’s collaboration partners in the marketplace; market competition; sales, marketing, manufacturing and distribution requirements; greater than expected expenses; expenses relating to litigation or strategic activities; the Company’s ability to satisfy its capital needs through increasing its revenue and obtaining additional financing; the impact of the COVID-19 pandemic, the disease caused by the SARS-CoV-2 virus or any similar events, which may adversely impact the Company’s business and pre-clinical and clinical trials; the impact of local, regional, and national and international economic conditions and events; and other risks detailed from time to time in the Company’s reports filed with the Securities and Exchange Commission. The Company disclaims any intent or obligation to update these forward-looking statements.

Investor Relations Contact:

Irina Koffler

LifeSci Advisors, LLC

(917) 734-7387

This email address is being protected from spambots. You need JavaScript enabled to view it.

| Last Trade: | US$10.49 |

| Daily Change: | 0.29 2.84 |

| Daily Volume: | 22,780 |

| Market Cap: | US$105.840M |

November 14, 2024 September 26, 2024 September 18, 2024 | |

Terns Pharmaceuticals is a clinical-stage biopharmaceutical company developing a portfolio of small-molecule product candidates to address serious diseases, including oncology and obesity. Terns’ pipeline contains three clinical stage development programs including GLP-1 receptor...

CLICK TO LEARN MORE

C4 Therapeutics is pioneering a new class of small-molecule drugs that selectively destroy disease-causing proteins via degradation using the innate machinery of the cell. This targeted protein degradation approach offers advantages over traditional drugs, including the potential to treat a wider range of diseases...

CLICK TO LEARN MOREEnd of content

No more pages to load

COPYRIGHT ©2023 HEALTH STOCKS HUB