SAN MATEO, Calif. / Aug 07, 2024 / Business Wire / BeiGene, Ltd. (NASDAQ: BGNE; HKEX: 06160; SSE: 688235), a global oncology company, today announced results from the second quarter 2024 and corporate updates that strengthen the Company for future global growth.

“This was a tremendous second quarter and an inflection point as BeiGene achieved positive non-GAAP operating income with rapidly increasing global revenues and continued financial discipline. Having now reached this milestone, we will further build on our differentiated, strategic capabilities as a leading, global oncology innovator,” said John V. Oyler, Co-Founder, Chairman and CEO of BeiGene. “BRUKINSA is emerging as the BTKi class leader in the U.S. in new patient starts across all approved indications, demonstrating the strength of its clinical efficacy and safety data, and is the only BTKi to demonstrate superior efficacy versus ibrutinib in a head-to-head trial. With our leadership in hematology, we are working to expand into other highly prevalent cancer types, backed by one of the largest oncology research teams in the industry. With our continued growth in established biopharmaceutical hubs such as New Jersey and Switzerland, we are better positioned to reach even more patients with our innovative medicines.”

Financial Highlights

(Amounts in thousands of U.S. dollars)

|

| Three Months Ended June 30, |

|

|

| Six Months Ended June 30, |

|

| ||||||||||||||

(in thousands, except percentages) |

|

| 2024 |

|

|

| 2023 |

|

| % Change |

|

| 2024 |

|

|

| 2023 |

|

| % Change | ||

Net product revenues |

| $ | 921,146 |

|

| $ | 553,745 |

|

| 66 | % |

| $ | 1,668,064 |

|

| $ | 964,036 |

|

| 73 | % |

Net revenue from collaborations |

| $ | 8,020 |

|

| $ | 41,516 |

|

| (81 | )% |

| $ | 12,754 |

|

| $ | 79,026 |

|

| (84 | )% |

Total Revenue |

| $ | 929,166 |

|

| $ | 595,261 |

|

| 56 | % |

| $ | 1,680,818 |

|

| $ | 1,043,062 |

|

| 61 | % |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||

GAAP loss from operations |

| $ | (107,161 | ) |

| $ | (318,715 | ) |

| (66 | )% |

| $ | (368,509 | ) |

| $ | (689,973 | ) |

| (47 | )% |

Adjusted income(loss) from operations* |

| $ | 48,464 |

|

| $ | (193,051 | ) |

| 125 | % |

| $ | (98,877 | ) |

| $ | (468,910 | ) |

| (79 | )% |

* For an explanation of our use of non-GAAP financial measures refer to the "Use of Non-GAAP Financial Measures" section later in this press release and for a reconciliation of each non-GAAP financial measure to the most comparable GAAP measures, see the table at the end of this press release.

Key Business Updates

BRUKINSA® (zanubrutinib)

TEVIMBRA® (tislelizumab)

Key Pipeline Highlights

Hematology

Sonrotoclax (BCL2 inhibitor)

BGB-16673 (BTK CDAC)

Solid Tumors

Lung Cancer

Breast and Gynecologic Cancers

Gastrointestinal Cancers

Immunology & Inflammation

Corporate Updates

Second Quarter 2024 Financial Highlights

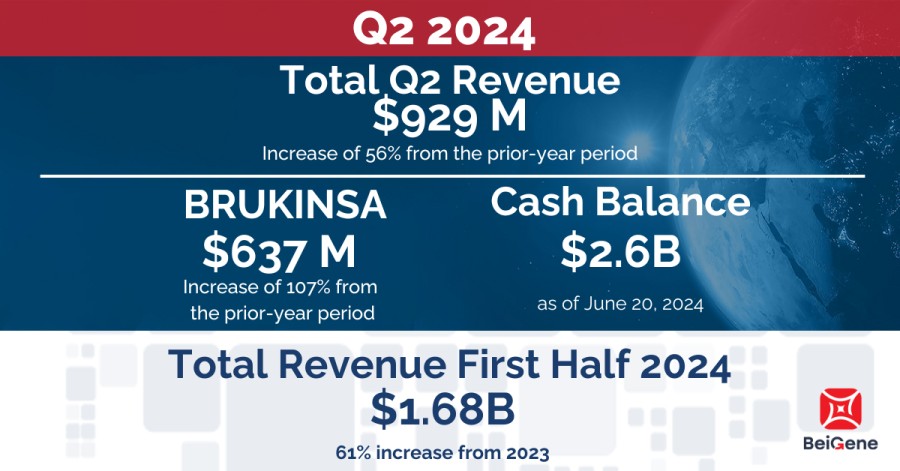

Revenue for the three months ended June 30, 2024, was $929 million, compared to $595 million in the same period of 2023, driven primarily by growth in BRUKINSA product sales in the U.S. and Europe of 114% and 209% respectively.

Product Revenue for the three months ended June 30, 2024, was $921 million, compared to $554 million in the same period of 2023, representing an increase of 66%. The increase in product revenue was primarily attributable to increased sales of BRUKINSA. For the three months ended June 30, 2024, the U.S. was the Company’s largest market, with product revenue of $479 million, compared to $224 million in the prior year period. In addition to BRUKINSA revenue growth, product revenues were positively impacted by sales of in-licensed products from Amgen in China and tislelizumab.

Gross Margin as a percentage of global product revenue for the second quarter of 2024 was 85%, compared to 83% in the prior-year period. The gross margin percentage increased primarily due to proportionally higher sales mix of global BRUKINSA compared to other products in the portfolio.

Operating Expenses

The following table summarizes operating expenses for the second quarter 2024 and 2023, respectively:

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

| GAAP |

|

|

| Non-GAAP |

|

| ||||||||||

(in thousands, except percentages) |

| Q2 2024 |

| Q2 2023 |

| % Change |

| Q2 2024 |

| Q2 2023 |

| % | ||||||

Research and development |

| $ | 454,466 |

| $ | 422,764 |

| 7 | % |

| $ | 382,509 |

| $ | 363,735 |

| 5 | % |

Selling, general and administrative |

| $ | 443,729 |

| $ | 395,034 |

| 12 | % |

| $ | 363,922 |

| $ | 331,607 |

| 10 | % |

Amortization |

| $ | — |

| $ | 188 |

| (100 | )% |

| $ | — |

| $ | — |

| NM |

|

Total operating expenses |

| $ | 898,195 |

| $ | 817,986 |

| 10 | % |

| $ | 746,431 |

| $ | 695,342 |

| 7 | % |

The following table summarizes operating expenses for the first half 2024 and 2023, respectively:

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

| GAAP |

|

|

| Non-GAAP |

|

| ||||||||||

(in thousands, except percentages) |

| Q2 YTD 2024 |

| Q2 YTD 2023 |

| % Change |

| Q2 YTD 2024 |

| Q2 YTD 2023 |

| % Change | ||||||

Research and development |

| $ | 915,104 |

| $ | 831,348 |

| 10 | % |

| $ | 787,949 |

| $ | 725,431 |

| 9 | % |

Selling, general and administrative |

| $ | 871,156 |

| $ | 723,533 |

| 20 | % |

| $ | 736,068 |

| $ | 614,761 |

| 20 | % |

Amortization |

| $ | — |

| $ | 375 |

| (100 | )% |

| $ | — |

| $ | — |

| NM |

|

Total operating expenses |

| $ | 1,786,260 |

| $ | 1,555,256 |

| 15 | % |

| $ | 1,524,017 |

| $ | 1,340,192 |

| 14 | % |

Research and Development (R&D) Expenses increased for the second quarter of 2024 compared to the prior-year period on both a GAAP and adjusted basis primarily due to advancing preclinical programs into the clinic and early clinical programs into late stage. Upfront fees and milestone payments related to in-process R&D for in-licensed assets totaled $12 million in the second quarter of 2024, compared to nil in the prior-year period.

Selling, General and Administrative (SG&A) Expenses increased for the second quarter of 2024 compared to the prior-year period on both a GAAP and adjusted basis due to continued investment in the global commercial launch of BRUKINSA, primarily in the U.S. and Europe. SG&A expenses as a percentage of product sales were 48% for the second quarter of 2024 compared to 71% in the prior year period.

Income (Loss) from Operations in the second quarter of 2024 operating loss decreased 66% on a GAAP basis. On an adjusted basis, we achieved operating income of $48 million. The decrease in GAAP operating loss and achievement of profitability on an adjusted basis is a key strategic goal and the result of tremendous efforts to drive growth while maintaining investment discipline.

GAAP Net Loss improved for the quarter ended June 30, 2024, compared to the prior-year period, as our product revenue growth and management of expenses is driving increased operating leverage.

For the quarter ended June 30, 2024, net loss per share were $(0.09) and $(1.15) per American Depositary Share (ADS), compared to $(0.28) per share and $(3.64) per ADS in the prior year period.

Cash Used in Operations for the quarter ended June 30, 2024, totaled $96 million compared to $294 million in the prior-year period, driven by improved operating leverage.

For further details on BeiGene’s Second Quarter 2024 Financial Statements, please see BeiGene’s Quarterly Report on Form 10-Q for the second quarter of 2024 filed with the U.S. Securities and Exchange Commission.

About BeiGene

BeiGene is a global oncology company that is discovering and developing innovative treatments that are more affordable and accessible to cancer patients worldwide. With a broad portfolio, we are expediting development of our diverse pipeline of novel therapeutics through our internal capabilities and collaborations. We are committed to radically improving access to medicines for far more patients who need them. Our growing global team of more than 10,000 colleagues spans five continents. To learn more about BeiGene, please visit www.beigene.com and follow us on LinkedIn, X (formerly known as Twitter) and Facebook.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other federal securities laws, including statements regarding BeiGene’s potential to further emerge as a leading, global oncology innovator; BeiGene’s ability to expand into other highly prevalent cancer types; BeiGene’s preliminary clinical data and activities, as well as anticipated read outs; whether shareholders will approve BeiGene’s change in jurisdiction of incorporation and if approved, whether this change will enable BeiGene to further execute on its global growth strategy; and BeiGene’s plans, commitments, aspirations and goals under the caption “About BeiGene”. Actual results may differ materially from those indicated in the forward-looking statements as a result of various important factors, including BeiGene’s ability to demonstrate the efficacy and safety of its drug candidates; the clinical results for its drug candidates, which may not support further development or marketing approval; actions of regulatory agencies, which may affect the initiation, timing and progress of clinical trials and marketing approval; BeiGene’s ability to achieve commercial success for its marketed medicines and drug candidates, if approved; BeiGene's ability to obtain and maintain protection of intellectual property for its medicines and technology; BeiGene’s reliance on third parties to conduct drug development, manufacturing, commercialization, and other services; BeiGene’s limited experience in obtaining regulatory approvals and commercializing pharmaceutical products; BeiGene’s ability to obtain additional funding for operations and to complete the development of its drug candidates and achieve and maintain profitability; and those risks more fully discussed in the section entitled “Risk Factors” in BeiGene’s most recent quarterly report on Form 10-Q, as well as discussions of potential risks, uncertainties, and other important factors in BeiGene’s subsequent filings with the U.S. Securities and Exchange Commission. All information in this press release is as of the date of this press release, and BeiGene undertakes no duty to update such information unless required by law.

Condensed Consolidated Statements of Operations (U.S. GAAP)

(Amounts in thousands of U.S. dollars, except for shares, American Depositary Shares (ADSs), per share and per ADS data)

| Three Months Ended June 30, |

| Six Months Ended June 30, | ||||||||||||

|

| 2024 |

|

|

| 2023 |

|

|

| 2024 |

|

|

| 2023 |

|

| (Unaudited) |

| (Unaudited) | ||||||||||||

Revenues |

|

|

|

|

|

|

| ||||||||

Product revenue, net | $ | 921,146 |

|

| $ | 553,745 |

|

| $ | 1,668,064 |

|

| $ | 964,036 |

|

Collaboration revenue |

| 8,020 |

|

|

| 41,516 |

|

|

| 12,754 |

|

|

| 79,026 |

|

Total revenues |

| 929,166 |

|

|

| 595,261 |

|

|

| 1,680,818 |

|

|

| 1,043,062 |

|

Cost of sales - products |

| 138,132 |

|

|

| 95,990 |

|

|

| 263,067 |

|

|

| 177,779 |

|

Gross profit |

| 791,034 |

|

|

| 499,271 |

|

|

| 1,417,751 |

|

|

| 865,283 |

|

Operating expenses: |

|

|

|

|

|

|

| ||||||||

Research and development |

| 454,466 |

|

|

| 422,764 |

|

|

| 915,104 |

|

|

| 831,348 |

|

Selling, general and administrative |

| 443,729 |

|

|

| 395,034 |

|

|

| 871,156 |

|

|

| 723,533 |

|

Amortization of intangible assets |

| — |

|

|

| 188 |

|

|

| — |

|

|

| 375 |

|

Total operating expenses |

| 898,195 |

|

|

| 817,986 |

|

|

| 1,786,260 |

|

|

| 1,555,256 |

|

Loss from operations |

| (107,161 | ) |

|

| (318,715 | ) |

|

| (368,509 | ) |

|

| (689,973 | ) |

Interest income, net |

| 13,225 |

|

|

| 15,070 |

|

|

| 29,385 |

|

|

| 31,086 |

|

Other expense, net |

| (11,984 | ) |

|

| (63,818 | ) |

|

| (10,222 | ) |

|

| (45,515 | ) |

Loss before income taxes |

| (105,920 | ) |

|

| (367,463 | ) |

|

| (349,346 | ) |

|

| (704,402 | ) |

Income tax expense |

| 14,485 |

|

|

| 13,674 |

|

|

| 22,209 |

|

|

| 25,166 |

|

Net loss |

| (120,405 | ) |

|

| (381,137 | ) |

|

| (371,555 | ) |

|

| (729,568 | ) |

|

|

|

|

|

|

|

| ||||||||

Net loss per share, basic and diluted | $ | (0.09 | ) |

| $ | (0.28 | ) |

| $ | (0.27 | ) |

| $ | (0.54 | ) |

Weighted-average shares outstanding—basic and diluted |

| 1,361,082,567 |

|

|

| 1,360,224,377 |

|

|

| 1,358,315,145 |

|

|

| 1,357,211,308 |

|

|

|

|

|

|

|

|

| ||||||||

Net loss per ADS, basic and diluted | $ | (1.15 | ) |

| $ | (3.64 | ) |

| $ | (3.56 | ) |

| $ | (6.99 | ) |

Weighted-average ADSs outstanding—basic and diluted |

| 104,698,659 |

|

|

| 104,632,644 |

|

|

| 104,485,780 |

|

|

| 104,400,870 |

|

Select Condensed Consolidated Balance Sheet Data (U.S. GAAP)

(Amounts in thousands of U.S. Dollars)

|

|

|

| ||

| As of | ||||

| June 30, |

| December 31, | ||

| 2024 |

| 2023 | ||

| (unaudited) |

| (audited) | ||

Assets: |

|

|

| ||

Cash, cash equivalents, and restricted cash | $ | 2,617,931 |

| $ | 3,185,984 |

Accounts receivable, net |

| 529,449 |

|

| 358,027 |

Inventories |

| 443,260 |

|

| 416,122 |

Property, plant and equipment, net |

| 1,516,491 |

|

| 1,324,154 |

Total assets |

| 5,712,179 |

|

| 5,805,275 |

Liabilities and equity: |

|

|

| ||

Accounts payable |

| 333,022 |

|

| 315,111 |

Accrued expenses and other payables |

| 646,538 |

|

| 693,731 |

R&D cost share liability |

| 203,627 |

|

| 238,666 |

Debt |

| 1,036,928 |

|

| 885,984 |

Total liabilities |

| 2,345,924 |

|

| 2,267,948 |

Total equity | $ | 3,366,255 |

| $ | 3,537,327 |

Note Regarding Use of Non-GAAP Financial Measures

BeiGene provides certain non-GAAP financial measures, including Adjusted Operating Expenses and Adjusted Operating Loss and certain other non-GAAP income statement line items, each of which include adjustments to GAAP figures. These non-GAAP financial measures are intended to provide additional information on BeiGene’s operating performance. Adjustments to BeiGene’s GAAP figures exclude, as applicable, non-cash items such as share-based compensation, depreciation and amortization. Certain other special items or substantive events may also be included in the non-GAAP adjustments periodically when their magnitude is significant within the periods incurred. BeiGene maintains an established non-GAAP policy that guides the determination of what costs will be excluded in non-GAAP financial measures and the related protocols, controls and approval with respect to the use of such measures. BeiGene believes that these non-GAAP financial measures, when considered together with the GAAP figures, can enhance an overall understanding of BeiGene’s operating performance. The non-GAAP financial measures are included with the intent of providing investors with a more complete understanding of the Company’s historical and expected financial results and trends and to facilitate comparisons between periods and with respect to projected information. In addition, these non-GAAP financial measures are among the indicators BeiGene’s management uses for planning and forecasting purposes and measuring the Company’s performance. These non-GAAP financial measures should be considered in addition to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. The non-GAAP financial measures used by the Company may be calculated differently from, and therefore may not be comparable to, non-GAAP financial measures used by other companies.

RECONCILIATION OF SELECTED GAAP MEASURES TO NON-GAAP MEASURES

(in thousands, except per share amounts)

(unaudited)

| Three Months Ended |

| Six Months Ended | ||||||||||||

| June 30, |

| June 30, | ||||||||||||

|

| 2024 |

|

|

| 2023 |

|

|

| 2024 |

|

|

| 2023 |

|

| (in thousands) |

| (in thousands) | ||||||||||||

Reconciliation of GAAP to adjusted cost of sales - products: |

|

|

|

|

|

|

| ||||||||

GAAP cost of sales - products | $ | 138,132 |

|

| $ | 95,990 |

|

| $ | 263,067 |

|

| $ | 177,779 |

|

Less: Depreciation |

| 2,684 |

|

|

| 2,180 |

|

|

| 5,029 |

|

|

| 4,360 |

|

Less: Amortization of intangibles |

| 1,177 |

|

|

| 840 |

|

|

| 2,360 |

|

|

| 1,639 |

|

Adjusted cost of sales - products | $ | 134,271 |

|

| $ | 92,970 |

|

| $ | 255,678 |

|

| $ | 171,780 |

|

|

|

|

|

|

|

|

| ||||||||

Reconciliation of GAAP to adjusted research and development: |

|

|

|

|

|

|

| ||||||||

GAAP research and development | $ | 454,466 |

|

| $ | 422,764 |

|

| $ | 915,104 |

|

| $ | 831,348 |

|

Less: Share-based compensation cost |

| 55,406 |

|

|

| 45,948 |

|

|

| 93,451 |

|

|

| 79,976 |

|

Less: Depreciation |

| 16,551 |

|

|

| 13,081 |

|

|

| 33,704 |

|

|

| 25,941 |

|

Adjusted research and development | $ | 382,509 |

|

| $ | 363,735 |

|

| $ | 787,949 |

|

| $ | 725,431 |

|

|

|

|

|

|

|

|

| ||||||||

Reconciliation of GAAP to adjusted selling, general and administrative: |

|

|

|

|

|

|

| ||||||||

GAAP selling, general and administrative | $ | 443,729 |

|

| $ | 395,034 |

|

| $ | 871,156 |

|

| $ | 723,533 |

|

Less: Share-based compensation cost |

| 75,288 |

|

|

| 57,381 |

|

|

| 125,957 |

|

|

| 98,741 |

|

Less: Depreciation |

| 4,519 |

|

|

| 6,046 |

|

|

| 9,131 |

|

|

| 10,031 |

|

Adjusted selling, general and administrative | $ | 363,922 |

|

| $ | 331,607 |

|

| $ | 736,068 |

|

| $ | 614,761 |

|

|

|

|

|

|

|

|

| ||||||||

Reconciliation of GAAP to adjusted operating expenses |

|

|

|

|

|

|

| ||||||||

GAAP operating expenses | $ | 898,195 |

|

| $ | 817,986 |

|

| $ | 1,786,260 |

|

| $ | 1,555,256 |

|

Less: Share-based compensation cost |

| 130,694 |

|

|

| 103,329 |

|

|

| 219,408 |

|

|

| 178,717 |

|

Less: Depreciation |

| 21,070 |

|

|

| 19,127 |

|

|

| 42,835 |

|

|

| 35,972 |

|

Less: Amortization of intangibles |

| — |

|

|

| 188 |

|

|

| — |

|

|

| 375 |

|

Adjusted operating expenses | $ | 746,431 |

|

| $ | 695,342 |

|

| $ | 1,524,017 |

|

| $ | 1,340,192 |

|

|

|

|

|

|

|

|

| ||||||||

Reconciliation of GAAP to adjusted income (loss) from operations: |

|

|

|

|

|

|

| ||||||||

GAAP loss from operations | $ | (107,161 | ) |

| $ | (318,715 | ) |

| $ | (368,509 | ) |

| $ | (689,973 | ) |

Plus: Share-based compensation cost |

| 130,694 |

|

|

| 103,329 |

|

|

| 219,408 |

|

|

| 178,717 |

|

Plus: Depreciation |

| 23,754 |

|

|

| 21,307 |

|

|

| 47,864 |

|

|

| 40,332 |

|

Plus: Amortization of intangibles |

| 1,177 |

|

|

| 1,028 |

|

|

| 2,360 |

|

|

| 2,014 |

|

Adjusted income (loss) from operations | $ | 48,464 |

|

| $ | (193,051 | ) |

| $ | (98,877 | ) |

| $ | (468,910 | ) |

| Last Trade: | US$176.50 |

| Daily Change: | 1.78 1.02 |

| Daily Volume: | 325,973 |

| Market Cap: | US$17.210B |

December 12, 2024 December 09, 2024 December 04, 2024 December 02, 2024 | |

Astria Therapeutics is a biopharmaceutical company, and our mission is to bring life-changing therapies to patients and families affected by rare and niche allergic and immunological diseases. Our lead program, STAR-0215, is a monoclonal antibody inhibitor of plasma kallikrein in clinical development...

CLICK TO LEARN MORE

Terns Pharmaceuticals is a clinical-stage biopharmaceutical company developing a portfolio of small-molecule product candidates to address serious diseases, including oncology and obesity. Terns’ pipeline contains three clinical stage development programs including GLP-1 receptor...

CLICK TO LEARN MOREEnd of content

No more pages to load

COPYRIGHT ©2023 HEALTH STOCKS HUB