Highlights:

Medical device companies provide investors with an excellent opportunity to gain exposure to the inevitable growing demand for healthcare services.

An aging global population, combined with an increase in the prevalence of chronic diseases, are further growing demand for innovative new medical devices and technologies.

The medical device industry is constantly evolving, with new products being developed to address more and more unmet medical needs. Companies that can innovate and bring new products to market will generate strong returns for investors.

Medical devices command high prices, which in turn translate into high profit margins for the companies that manufacture and sell them.

Additionally, many medical device companies offer a wide range of products across multiple therapeutic areas, which can help to diversify their revenue streams and reduce risk.

There are currently more than 200 publicly traded medical device companies as well as hundreds of private companies.

The largest medical device companies by market cap today include Abbott Laboratories (NYSE: ABT), Medtronic (NYSE: MDT), Stryker (NYSE: SYK), and Intuitive Surgical (NASDAQ: ISRG).

One example of a highly successful medical device company that has grown from a startup into one of the largest in the world is Intuitive Surgical. Based in Chicago, Illinois, the company designs, manufactures, and markets robotic surgical systems.

It’s flagship product, the da Vinci Surgical System, is used for minimally invasive surgical procedures in a wide range of medical specialties, including urology, gynecology, and general surgery. The product sells for $1.5 million per unit and generates nearly $5 billion in revenue for the company each year.

Intuitive went public in the year 2000 and traded as low as $0.84 per share in 2001. An investor who purchased 5,000 shares in 2002 and held through today would have seen their original $50,000 investment increase in value to more than $6.8 million today.

Despite never paying a dividend to shareholders, early investors in Intuitive Surgical have enjoyed a split adjusted return of nearly 14,000% on their original investment.

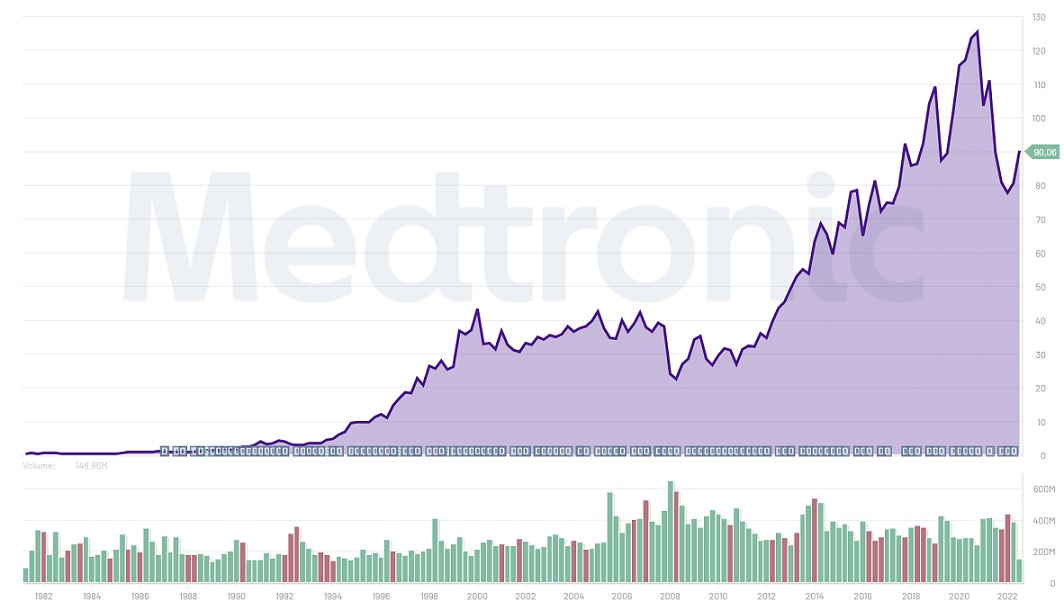

Another example of a medical device company that has created significant value for its shareholders is Medtronic.

Founded in 1949, Medtronic’s initial focus was on creating medical devices to treat heart conditions. The company’s first product was a battery-powered pacemaker, which revolutionized the treatment of heart disease.

Over the years, Medtronic continued to expand its product offerings, developing new devices for a range of medical conditions, including diabetes, spinal disorders, and neurological disorders.

In the 1990s, Medtronic continued to grow through a series of acquisitions, purchasing companies that specialized in areas such as surgical instruments, cardiovascular devices, and neuromodulation technology.

In 1999, the company acquired Arterial Vascular Engineering, which at the time made Medtronic the largest medical device company in the world.

Today, Medtronic is a global company with operations across more than 160 countries. The company's products are used by millions of people around the world, and its technologies continue to advance the field of medical care.

In fiscal year 2022, the company generated more than $31 billion in revenue and enjoyed its 45th consecutive year of dividend increases.

Investors who purchased $50,000 of Medtronic stock in 1995 and have continuously reinvested dividend payments would now be sitting on an unrealized gain worth more than $737,500. This represents a 1,376% increase in value from the original investment.

These are just two examples in which medical device stocks have created significant wealth for shareholders over the long term. Going forward, the potential to invest in the next generation of medical device companies also remains bright.

Technological advancements in the medical device industry will continue to improve patient outcomes and reduce healthcare costs. This includes the use of artificial intelligence, robotics, and miniaturization to create more advanced and efficient products.

With the increasing availability of genetic testing and personalized medicine, the outlook for medical device companies to focus on creating products that can be tailored to individual patients' needs and characteristics suggest that the coming decades will offer investors new opportunities for tremendous gains.

Other up and coming medical device companies to watch:

For a full list of all publicly traded medical device companies visit: https://healthstockshub.com/stocks/medical-stocks/medical-device-stocks

Terns Pharmaceuticals is a clinical-stage biopharmaceutical company developing a portfolio of small-molecule product candidates to address serious diseases, including oncology and obesity. Terns’ pipeline contains three clinical stage development programs including GLP-1 receptor...

CLICK TO LEARN MORE

ClearPoint Neuro is a global therapy-enabling platform company providing stereotactic navigation and delivery to the brain. Applications of our ClearPoint Neuro Navigation System include electrode lead placement, placement of catheters, and biopsy. The platform has FDA clearance and is...

CLICK TO LEARN MOREEnd of content

No more pages to load

COPYRIGHT ©2023 HEALTH STOCKS HUB