TORONTO, ON / ACCESSWIRE / November 29th, 2023 / Theralase® Technologies Inc. ("Theralase®" or the "Company") (TSXV:TLT) (OTCQB:TLTFF), a clinical stage pharmaceutical company dedicated to the research and development of light and/or radiation activated Photo Dynamic Compounds ("PDCs") for the safe and effective destruction of various cancers, bacteria and viruses has released the Company's 3Q2023 unaudited condensed interim consolidated Financial Statements ("Financial Statements").

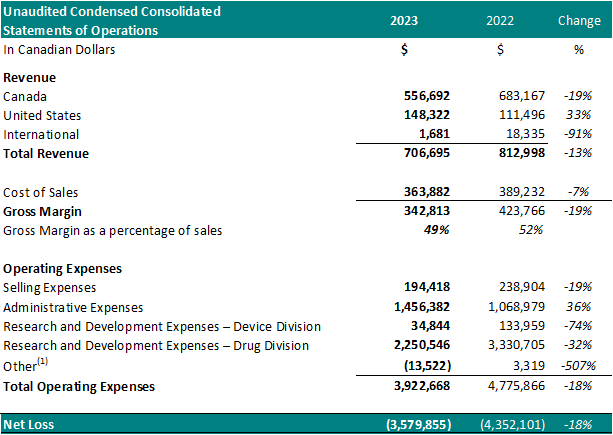

Financial Summary:

For the nine-month period ended September 30th:

1 Other represents foreign exchange, interest accretion on lease liabilities and / or interest income

Financial Highlights for the Nine-Month Period Ended September 30th, 2023:

Total revenue decreased 13%, year over year.

Cost of sales for the nine-month period ended September 30th, 2023 was $363,882 or 51% of revenue resulting in a gross margin of $342,813 or 49% of revenue. In comparison, the cost of sales for the same period in 2022 was $389,232 or 48% of revenue resulting in a gross margin of $423,766 or 52% of revenue. Cost of sales is represented by the following costs: raw materials, subcontracting, direct and indirect labour and the applicable share of manufacturing overhead.

The gross margin decrease, as a percentage of sales, year over year, is primarily attributed to an increase in material costs.

Selling expenses for the six-month period ended September 30th, 2023 decreased to $194,418 from $238,904 for the same period in 2022, a 19% decrease. The decrease in selling expenses is a result of reduced advertising (24%) and salaries (25%).

Administrative expenses for the nine-month period ended September 30th, 2023, increased to $1,456,382 from $1,060,980 for the same period in 2022, a 36% increase. The increase in administrative expenses is primarily attributed to increased spending on general and administrative expenses (82%) and director and advisory fees (35%). Stock based compensation expense increased 319% from 2022 due to an increase in stock options granted.

Net research and development expenses for the nine-month period ended September 30th, 2023, decreased to $2,250,546 from $3,330,705 for the same period in 2022 for the Drug Division, a 32% decrease and decreased to $34,844 from $133,959 for the same period in 2022 for the Device Division, a 74% decrease. The decrease in research and development expenses, for the Drug Division, is primarily attributed to the costs related to the manufacture of the Study II Drug. The decrease in research and development expenses, for the Device Division, is primarily attributed to the costs related to the manufacture of the Study II Device. Research and development expenses represented 58% of the Company's operating expenses and represent investment into the research and development of the Company's Drug Division Anti-Cancer Therapy ("ACT") technology.

The net loss for the nine month period ended September 30th, 2023, was $3,579,855, which included $714,020 of net non-cash expenses (i.e.: amortization, stock-based compensation expense and foreign exchange gain/loss). This compared to a net loss for the same period in 2022 of $4,352,101, which included $391,321 of net non-cash expenses. The Drug Division represented $3,123,435 of this loss (87%) for the nine month period ended September 30th, 2023. The decrease in net loss is primarily attributed to decreased spending on research and development expenses in Study II.

Operational Highlights:

Non-Brokered Private Placement

On September 7, 2023, the Company completed a financing by way of a non-brokered private placement, where 1,840,000 units were issued at a price of $CAN 0.25 per unit for gross proceeds of $CAN 460,000. Each unit consisted of 1 common share and 1 non-transferable common share purchase warrant. Each whole warrant entitles the holder thereof to acquire 1 common share at a price of $CAN 0.35, expiring on September 7, 2025. An aggregate of 424,000 Units, representing gross proceeds of $CAN 106,000, were issued to certain insiders of the Corporation.

On November 29, 2023, the Company closed a non-brokered private placement of units. On closing, the Company issued an aggregate of 5,318,183 units at a price of $0.22 per Unit for aggregate gross proceeds of approximately $CAN 1,170,000 of which 461,282 units were purchased by certain insiders of the Corporation. Each Unit consists of one common share of the Company and one non-transferable common share purchase warrant. Each Warrant entitles the holder to acquire an additional Common Share at a price of $0.28 for a period of 5 years following the date of issuance.

Break Through Designation Update

The Company has submitted a pre-BTD submission to the FDA and based on the FDA's feedback, the Company is currently working with the Clinical Study Sites ("CSSs"), a biostatistics organization and a regulatory organization to update the pre-BTD with clinical data clarifications identified by the FDA. The Company plans to resubmit the pre-BTD submission to the FDA in early 1Q2024 for FDA review of these clarifications. Once the pre-BTD submission has been accepted by the FDA, the Company plans to compile a BTD submission for review by the FDA in support of the grant of a BTD approval in 1Q2024.

Study II Preliminary Clinical Data:

To date, Study II has provided the primary study treatment for 63 patients.

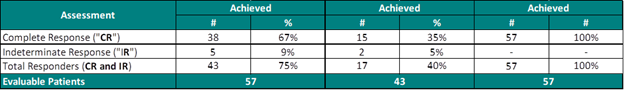

Performance to Primary, Secondary and Tertiary Objectives

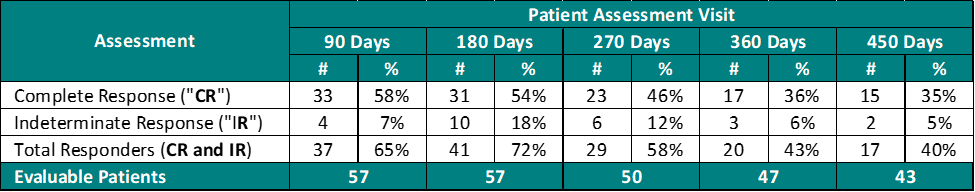

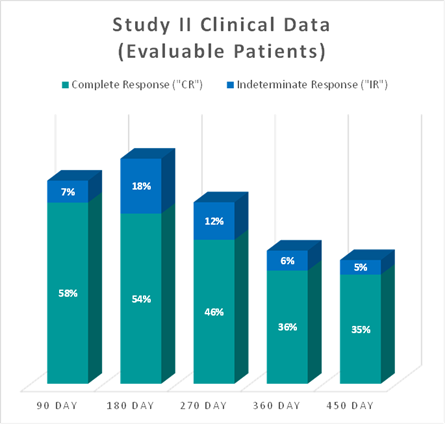

Study II Clinical Data Based on Assessment Visit

The interim clinical data demonstrates that at the 90 Day Assessment 58% of Evaluable Patients achieved a CR and 65% achieved a Total Response (CR + IR) post primary Study II Treatment and at 450 days 35% achieved a CR and 40% achieved a TR.

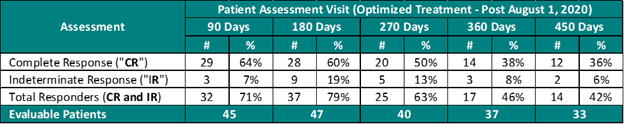

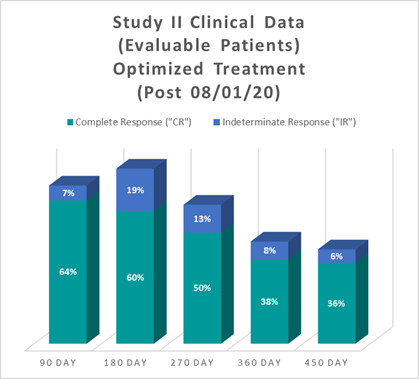

Study II Clinical Data Based on Assessment Visit for Patients Treated with the Optimized Study II Treatment (Post August 1, 2020)

The interim clinical data demonstrates that at the 90 Day Assessment 64% of Evaluable Patients achieved a CR and 71% achieved a Total Response (CR + IR) post primary Study II Treatment with the Optimized Study II Treatment and at 450 days 36% achieved a CR and 42% achieved a TR.

Note:

Patient Response Chart

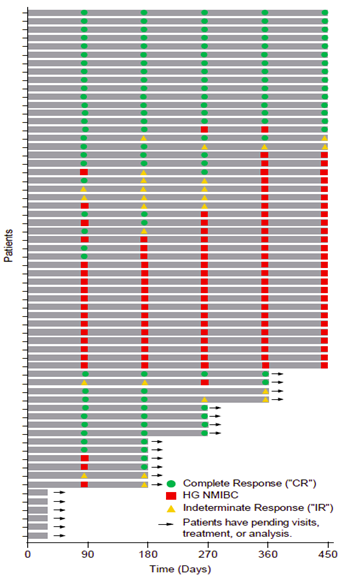

The Swimmer's plot below is a graphical representation of the interim clinical results (n=63) graphically demonstrating a patient's response to a treatment over time. As can be seen in the plot, clinical data is still pending for patients, who have demonstrated an initial CR at 90 days and continue to demonstrate a duration of that response.

Swimmer's Plot:

The Swimmer's Plot illustrates:

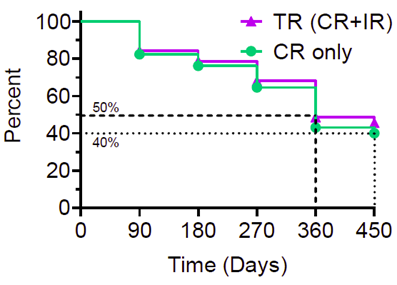

Kaplan-Meier Curve

The Kaplan-Meier ("KM") Curve represents the interim cumulative incidence of clinical events, including the treatment efficacy, occurring over prespecified time in Study II.

According to the interim clinical data in the KM curve:

Serious Adverse Events

For 63 patients treated in Study II, there have been 11 Serious Adverse Events ("SAEs") reported:

Theralase® believes all SAEs reported to date are unrelated to the Study II Drug or Study II Device, as reviewed and confirmed by the independent Data Safety Monitoring Board ("DSMB").

Note: A SAE is defined as any untoward medical occurrence that at any dose: Is serious or life-threatening, requires inpatient hospitalization or prolongation of existing hospitalization, results in persistent or significant disability/incapacity, is a congenital anomaly/birth defect or results in death.

About Study II:

Study II utilizes the therapeutic dose of the patented Study II Drug ( "RuvidarTM" or "TLD-1433") (0.70 mg/cm2) activated by the proprietary Study II Device (TLC-3200 Medical Laser System or "TLC-3200"). Study II is focused on enrolling and treating approximately 100 BCG-Unresponsive NMIBC Carcinoma In-Situ ("CIS") patients in up to 15 Clinical Study Sites ("CSS") located in Canada and the United States.

About RuvidarTM:

RuvidarTM is a patented PDC with 12 years of published peer reviewed preclinical research and is currently under investigation in Study II.

About Theralase® Technologies Inc.:

Theralase® is a clinical stage pharmaceutical company dedicated to the research and development of light activated compounds, their associated drug formulations and the light systems that activate them, with a primary objective of efficacy and a secondary objective of safety in the destruction of various cancers, bacteria and viruses.

Additional information is available at www.theralase.com and www.sedar.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward Looking Statements:

This news release contains "forward-looking statements" within the meaning of applicable Canadian securities laws. Such statements include; but are not limited to statements regarding the Company's proposed development plans with respect to Photo Dynamic Compounds and their drug formulations. Forward looking statements may be identified by the use of the words "may, "should", "will", "anticipates", "believes", "plans", "expects", "estimate", "potential for" and similar expressions; including, statements related to the current expectations of Company's management for future research, development and commercialization of the Company's Photo Dynamic Compounds and their drug formulations, preclinical research, clinical studies and regulatory approvals.

These statements involve significant risks, uncertainties and assumptions; including, the ability of the Company to: adequately fund, and secure the requisite regulatory approvals to successfully complete a Phase II NMIBC clinical study in a timely fashion and implement its development plans. Other risks include: the ability of the Company to successfully commercialize its drug formulations, the risk that access to sufficient capital to fund the Company's operations may not be available or may not be available on terms that are commercially favorable to the Company, the risk that the Company's drug formulations may not be effective against the diseases tested in its clinical studies, the risk that the Company's fails to comply with the term of license agreements with third parties and as a result loses the right to use key intellectual property in its business, the Company's ability to protect its intellectual property, the timing and success of submission, acceptance and approval of regulatory filings, and the impacts of public health crises, such as COVID-19. Many of these factors that will determine actual results are beyond the Company's ability to control or predict.

Readers should not unduly rely on these forward- looking statements which are not a guarantee of future performance. There can be no assurance that forward looking statements will prove to be accurate as such forward looking statements involve known and unknown risks, uncertainties and other factors which may cause actual results or future events to differ materially from the forward-looking statements.

Although the forward-looking statements contained in the press release are based upon what management currently believes to be reasonable assumptions, the Company cannot assure prospective investors that actual results, performance or achievements will be consistent with these forward-looking statements.

All forward-looking statements are made as of the date hereof and are subject to change. Except as required by law, the Company assumes no obligation to update such statements.

For More Information:

1.866.THE.LASE (843-5273)

416.699.LASE (5273)

www.theralase.com

Kristina Hachey, CPA

Chief Financial Officer

This email address is being protected from spambots. You need JavaScript enabled to view it.

| Last Trade: | C$0.26 |

| Daily Volume: | 0 |

| Market Cap: | C$64.420M |

December 09, 2024 December 05, 2024 November 27, 2024 November 15, 2024 | |

Amneal Pharmaceuticals is a fully-integrated essential medicines company. We make healthy possible through the development, manufacturing, and distribution of generic and specialty pharmaceuticals. The Company has a diverse portfolio of over 250 products in its Generics segment and is expanding across...

CLICK TO LEARN MORE

Compass Therapeutics is a clinical-stage, oncology-focused biopharmaceutical company developing proprietary antibody-based therapeutics to treat multiple human diseases. The company's scientific focus is on the relationship between angiogenesis, the immune system, and tumor growth...

CLICK TO LEARN MOREEnd of content

No more pages to load

COPYRIGHT ©2023 HEALTH STOCKS HUB