CALGARY, AB, April 29, 2024 /CNW/ - Nanalysis Scientific Corp. ("the Company") (TSXV: NSCI) (OTCQX: NSCIF) (FRA: 1N1), a leader in portable NMR machines and MRI technology for industrial and research applications announces fourth quarter and full year results for the period ending on December 31, 2023. Chief Executive Officer, Sean Krakiwsky and Chief Financial Officer, Randall McRae will host a conference call at 5 P.M. Eastern Time today to discuss the results. A second call will be held for European investors at 8:30am ET tomorrow, Tuesday, April 30th. All interested parties are invited to join these calls.

"As noted in our previous release dated February 6, 2024, we are very pleased with how our businesses ramped up in second half of 2023 and we closed out the year with good momentum which has carried into the current year," said Sean Krakiwsky, Founder and CEO of Nanalysis. "Our benchtop sales have regained stride and the personnel changes that we made earlier in the year are producing good results that we expect to continue going forward. Our security services segment completed taking over all basic services on the Company's Airport Security Project early in 2024, and this project will continue its expansion and roll-out, building towards full revenue run rate through the year. Additionally, in 2023 we had significant up-front training costs which contracted our margins. In 2024, we expect that to be significantly reduced and look for security services margins to improve throughout the year."

Financial highlights for the three months ended December 31, 2023:

Three months ended | ||||

($000's) | 2023 | 2022 | ($) | |

Product sales | 5,450 | 5,893 | (443) | |

Service revenue | 4,350 | 1,310 | 3,040 | |

Total sales and revenue | 9,800 | 7,203 | 2,597 | |

Gross margin - product sales | 48 % | 32 % | 16 % | |

Gross margin - service revenue | -21 % | -50 % | 29 % | |

EBITDA | (774) | (2,532) | 1,758 | |

Net loss | (2,123) | (3,292) | 1,169 | |

Financial highlights for the twelve months ended December 31, 2023:

Twelve months ended | ||||

($000's) | 2023 | 2022 | ($) Change | |

Product sales | 16,342 | 21,588 | (5,246) | |

Service revenue | 12,124 | 3,233 | 8,891 | |

Total sales and revenue | 28,466 | 24,821 | 3,645 | |

Gross margin percentage - product sales | 41 % | 49 % | -8 % | |

Gross margin percentage - service revenue | -23 % | -1 % | -22 % | |

EBITDA | (8,074) | (3,935) | (4,139) | |

Net loss | (16,784) | (9,915) | (6,869) | |

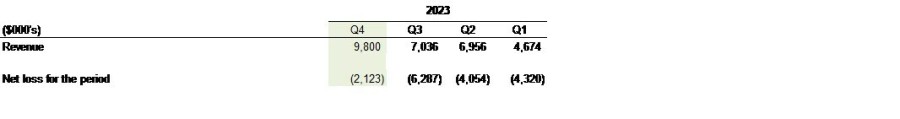

Quarterly Trend:

Recent strategic and operational highlights during and after the fourth quarter of 2023 include:

Outlook

"We are very encouraged by the continued sequential growth of our benchtop sales quarterly last year and we believe we can maintain strength in our product sales into 2024," said Sean Krakiwsky, Founder and CEO of Nanalysis. "The operational changes and leadership changes that we put in place in both our sales organisation and Security Services are paying off and we believe we will continue to foster growth in the current year. We continue to demonstrate that we are a leader in Benchtop NMR and plan to retain that position through continued innovation and advancement of technologies used in our product line. Lastly, the changes implemented by right sizing our R&D and manufacturing capacity, particularly as it relates to Benchtop NMR, positions us to grow both our topline and margins in 2024, as we move towards profitability.

Conference Call

Investors interested in participating in the live full year call can dial 1-888-664-6392 or 416-764-8659 from abroad. Investors can also access the call online through a listen-only webcast here: https://app.webinar.net/9xEage3Q0PB or on the investor relations section of the Company's website HERE.

The webcast will be archived on the Company's investor relations webpage for at least 90 days and a telephonic playback will be available for seven days after the conference call by calling 1-888-390-0541 or 416-764-8677, conference ID # 093791.

Additionally, the Company will be hosting a Q&A session for it's European investors at 8:30am ET tomorrow, Tuesday, April 30th which can be accessed by the following link: Join the meeting now

Non-IFRS and Supplementary Financial Measures

The Company prepares and reports its consolidated financial statements in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board, as adopted by the Canadian Accounting Standards Board ("IFRS"). However, this press release may make reference to certain non-IFRS measures including key performance indicators used by management. These measures are not recognized measures under IFRS and do not have a standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other companies. Rather, these measures are provided as additional information to complement those IFRS measures by providing further understanding of the Company's results of operations from management's perspective. Accordingly, these measures should not be considered in isolation nor as a substitute for analysis of the Company's financial information reported under IFRS.

The Company uses Earnings Before Interest, Tax, Depreciation and Amortization ("EBITDA") as a non-IFRS measure, which may be calculated differently by other companies. This non-IFRS measure is used to provide investors with a supplemental measure of the Company's operating performance and liquidity and thus highlight trends in the Company's business that may not otherwise be apparent when relying solely on IFRS measures. The Company also believes that securities analysts, investors and other interested parties frequently use non-IFRS measures in the evaluation of companies in similar industries.

Three months ended December 31 | Twelve months ended December 31 | ||||||

($000's) | 2023 | 2022 | ($) Change | 2023 | 2022 | ($) Change | |

Net loss | (2,123) | (3,292) | 1,169 | (16,784) | (9,915) | (6,869) | |

Business acquisition costs and contingent consideration (gain) loss | (1,106) | (106) | (1,000) | (967) | 104 | (1,071) | |

Depreciation and amortization expense | 1,052 | 1,233 | (181) | 4,413 | 4,564 | (151) | |

Finance expense (income) | 43 | (124) | 167 | 284 | 76 | 208 | |

Stock-based compensation | 187 | 454 | (267) | 1,048 | 1,556 | (508) | |

Foreign exchange (gain) loss | (84) | 5 | (89) | 165 | 164 | 1 | |

Loss on loss of control of subsidiary | - | - | - | 2,810 | - | 2,810 | |

Loss from associate | 271 | - | 271 | 527 | - | 527 | |

Restructuring costs | 4 | - | 4 | 441 | - | 441 | |

Current income tax (recovery) expense | (3) | 53 | (56) | 13 | 250 | (237) | |

Deferred income tax expense (recovery) | 985 | (755) | 1,740 | (24) | (734) | 710 | |

EBITDA | (774) | (2,532) | 1,758 | (8,074) | (3,935) | (4,139) | |

Supplementary Financial Measures

The Company may also use supplementary financial measures which are intended to be disclosed on a periodic basis to depict the historical or expected future financial performance, cash position, or cash flow of the Company, are not a non-IFRS measure, and are not presented in the financial statements. The measures as discussed in this press release include:

About Nanalysis Scientific Corp. (TSXV: NSCI, OTCQX: NSCIF, FRA:1N1)

Nanalysis Scientific Corp. in operates two primary business segments: Scientific Equipment and Security Services. Within its Scientific Equipment business is what the Company terms "MRI and NMR for industry". The Company develops and manufactures portable Nuclear Magnetic Resonance (NMR) spectrometers or analyzers for laboratory and industrial markets. The NMReady-60™ was the first full-feature portable NMR spectrometer in a single compact enclosure requiring no liquid helium or any other cryogens. The Company has followed-up that initial offering with new products and continues to have a strong innovation pipeline. In 2020, the Company announced the launch of its 100MHz device, the most powerful and most advanced compact NMR device ever brought to market.

The Company's devices are used in many industries (oil and gas, chemical, mining, pharma, biotech, flavor and fragrances, agrochemicals, law enforcement, and more) as well as numerous government and university research labs around the world. The Company continues to exploit new global market opportunities independently and with partners. With its partners, the Company provides scientific equipment sales and maintenance services globally.

In 2022 the Company was awarded a five-year, $160 million contract to provide maintenance services for passenger screening equipment in Canadian airports. This has resulted in expansion of the Company's Security Services business. The Company is providing airport security equipment maintenance services in each province and territory of Canada. In addition, the Company provides commercial security equipment installation and maintenance services to a variety of customers in North America.

Notice regarding Forward Looking Statements and Legal Disclaimer

This news release contains certain "forward-looking statements" within the meaning of such statements under applicable securities law. Forward-looking statements are frequently characterized by words such as "anticipates", "plan", "continue", "expect", "project", "intend", "believe", "anticipate", "estimate", "may", "will", "potential", "proposed", "positioned" and other similar words, or statements that certain events or conditions "may" or "will" occur. These statements are only predictions. Various assumptions were used in drawing the conclusions or making the projections contained in the forward-looking statements throughout this news release. Forward-looking statements are based on the opinions and estimates of management at the date the statements are made and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking statements. The Company is under no obligation, and expressly disclaims any intention or obligation, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by applicable law.

Neither TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

| Last Trade: | C$0.37 |

| Daily Change: | -0.005 -1.35 |

| Daily Volume: | 33,888 |

| Market Cap: | C$41.270M |

November 21, 2024 October 22, 2024 October 03, 2024 August 28, 2024 | |

Recursion Pharmaceuticals is a clinical stage TechBio company leading the space by decoding biology to industrialize drug discovery. Enabling its mission is the Recursion OS, a platform built across diverse technologies that continuously expands one of the world’s largest....

CLICK TO LEARN MORE

C4 Therapeutics is pioneering a new class of small-molecule drugs that selectively destroy disease-causing proteins via degradation using the innate machinery of the cell. This targeted protein degradation approach offers advantages over traditional drugs, including the potential to treat a wider range of diseases...

CLICK TO LEARN MOREEnd of content

No more pages to load

COPYRIGHT ©2023 HEALTH STOCKS HUB