ROCHESTER, Mich., May 24, 2023 (GLOBE NEWSWIRE) -- OptimizeRx Corp. (the “Company”) (Nasdaq: OPRX), a leading provider of point-of-care technology solutions helping patients start and stay on therapy, provides a 2023 mid-year strategic update commenting on: 1) current revenue backlog, 2) strategic roadmap with key pillars of growth, and 3) long term financial performance aspirations through steady buildout of scalable, future proofed, enterprise solution suite.

Dear OptimizeRx Shareholders,

Although we reported our financial earnings recently, I wanted to share in more detail what has me excited about our prospects. We re-founded the Company in 2016 with a driving, compulsive obsession — to empower life science organizations with the ability to nurture brand engagement with prescribers and patients alike. Our efforts to fulfill this mission have resulted in the buildout of a sophisticated, integrated suite of tech-enabled solutions operating at multiple touch points within the point of care. Our capabilities today are both far reaching and refined as compared to our early days as a start-up, with a single, standalone affordability messaging product.

Midyear revenue backlog

Today, our mission and passion continue to power drug maker brand awareness with prescribing physicians through patient treatment initiation, affordability and adherence. These efforts are packaged in a comprehensive, best-in-class enterprise solutions suite. Having finished the first quarter of 2023 achieving $13 million in revenues, which was at the high end of revenue guidance, we are confident in our operational and financial visibility. We are also operating on renewed fervor, riding on the coattails of industry tailwinds which is likely to produce stronger results through the remainder of 2023. Halfway into the second quarter’s sales cycle, our midyear results are starting to crystallize, and we can confidently say that OptimizeRx is well within striking distance of our end of year goals. We guided revenue to improve by at least 10% over the prior year and, as it stands today, our committed backlog stands between 60-70% of the full year revenue – an improvement over the prior year.

Strategic roadmap and key growth pillars

Integrated engagement approach for all stakeholders

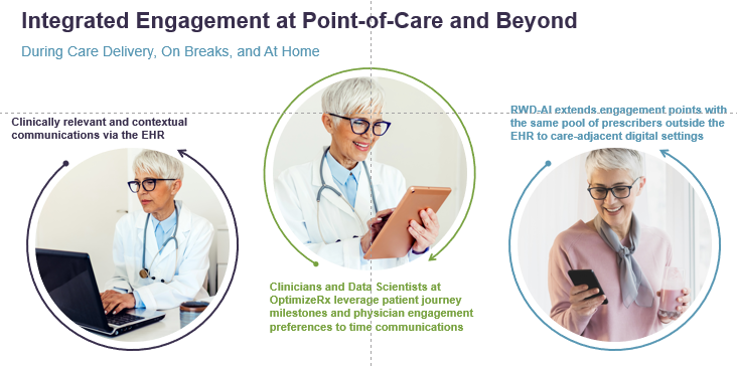

In spite of prolonged challenges with the macro-environment, coupled with the short-term noise of disengaged, standalone offerings from new competitors, we continue to future proof OptimizeRx’s utility to customers. Driving this dynamic is our machine learning based approach to integrated engagement at point-of-care and beyond.

Reaching deep across a comprehensive toolkit of solutions, we are delivering clinically relevant and contextual communications through electronic health records (EHRs). We further leverage patient journey milestones and physician engagement preferences to initiate timely follow-up communications.

Innovation and smart acquisitions currently driving growth

We spent two years developing our RWD.AI platform to extend engagement points with the same pool of prescribers outside the EHR and into care-adjacent digital settings such as social media where we have access to over 2 million HCP profiles and 90% of the nation’s health system intranet/websites. Since acquiring EvinceMed, that gave us a modular automation architecture, purpose-built for specialty therapies, we have continued to stay ahead of the industry curve with innovations that have enhanced our smart, data-driven technology offerings, which now includes web display. Now, our RWD.AI platform can eliminate bottlenecks, speed time to therapy, and reduce costs. We continue to build best-in-class reporting, a critical feature our customers tell us is necessary for all new business proposals as they look to gather information on audience, returns on investment (ROIs), and physician-level data. Through M&A and strategic partnerships, we are also actively seeking ways to further enhance revenue streams through omni-channel expansion, proprietary data analytics and insight generation.

18 to 24 months financial aspirations

As a result of our innovation and foresight, we firmly believe our solutions are meaningfully contributing to the improvement of patient care journeys and our customers’ marketing ROIs. We remain committed to our vision of profitable long-term growth, fully expecting to achieve 20% adjusted EBITDA - or better- on $100-120 million in revenue in the next 18 to 24 months.

We are evolving as a strategic partner by bringing broad reach and deep expertise in tech-enabled commercial solutions to life science customers’ communications between brands and patients. OptimizeRx is already embedded with most major pharmaceutical manufacturers, and we are completely focused on a land and expand strategy. We also are maintaining a strong cash position, providing fuel for future organic and inorganic growth. Finally, in beating our first-quarter revenue guidance and, with our mid-year backlog of revenues firmly in hand, we believe full-year guidance is achievable despite an improving but still challenging headwind around drug approvals. Having renewed our share buyback program, we can opportunistically deploy capital into the Company in the most meaningful and beneficial way for our shareholders.

Thank you once again for staying the course with us. We look forward to sharing our results on the next conference call.

Sincerely,

Will Febbo

OptimizeRx CEO

About OptimizeRx

OptimizeRx provides best-in-class health technology that enables care-focused engagement between life sciences organizations, healthcare providers, and patients at critical junctures throughout the patient care journey. Connecting over 60% of U.S. healthcare providers and millions of their patients through an intelligent technology platform embedded within a proprietary digital point-of-care network, OptimizeRx helps patients start and stay on their medications.

For more information, follow the Company on Twitter, LinkedIn or visit www.optimizerx.com.

Important Cautions Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “anticipates”, “believes”, “estimates”, “expects”, “forecasts”, “intends”, “plans”, “projects”, “targets”, “designed”, “could”, “may”, “should”, “will” or other similar words and expressions are intended to identify these forward-looking statements. All statements that reflect the Company’s expectations, assumptions, projections, beliefs, or opinions about the future, other than statements of historical fact, are forward-looking statements, including, without limitation, statements relating to the Company’s growth, business plans, and future performance. These forward-looking statements are based on the Company’s current expectations and assumptions regarding the Company’s business, the economy, and other future conditions. The Company disclaims any intention or obligation to publicly update or revise any forward-looking statements, whether because of new information, future events, or otherwise, except as required by applicable law. Forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified. Future events and actual results could differ materially from those set forth in, contemplated by, or underlying the forward-looking statements. The risks and uncertainties to which forward-looking statements are subject include, but are not limited to, the effect of government regulation, competition, and other risks summarized in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, its subsequent Quarterly Reports on Form 10-Q, and its other filings with the Securities and Exchange Commission.

OptimizeRx Contact

Andy D’Silva, SVP Corporate Finance

This email address is being protected from spambots. You need JavaScript enabled to view it.

Media Relations Contact

Kimberley Sirk, Media Relations Manager

This email address is being protected from spambots. You need JavaScript enabled to view it.

Investor Relations Contact

Ashley Robinson

LifeSci Advisors, LLC

This email address is being protected from spambots. You need JavaScript enabled to view it.

| Last Trade: | US$4.94 |

| Daily Change: | 0.11 2.28 |

| Daily Volume: | 204,583 |

| Market Cap: | US$90.990M |

December 23, 2024 November 13, 2024 September 09, 2024 August 08, 2024 | |

Amneal Pharmaceuticals is a fully-integrated essential medicines company. We make healthy possible through the development, manufacturing, and distribution of generic and specialty pharmaceuticals. The Company has a diverse portfolio of over 250 products in its Generics segment and is expanding across...

CLICK TO LEARN MORE

Terns Pharmaceuticals is a clinical-stage biopharmaceutical company developing a portfolio of small-molecule product candidates to address serious diseases, including oncology and obesity. Terns’ pipeline contains three clinical stage development programs including GLP-1 receptor...

CLICK TO LEARN MOREEnd of content

No more pages to load

COPYRIGHT ©2023 HEALTH STOCKS HUB